florida estate tax limit

This portal provides all of PTOs published. County municipal and independent special district property tax levies have been subject to the maximum millage limitations in s.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

The increase will go into effect on January 1 2020.

. If inflation was 10 youd use 3 as the maximum increase. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the Florida Department of Revenue. Florida homestead properties receive up to a 50000 exemption from property taxes.

So even though your property appraises at 105000 you only get taxed on 102000. And on Fridays from 830 am. Florida primary residences are protected to a.

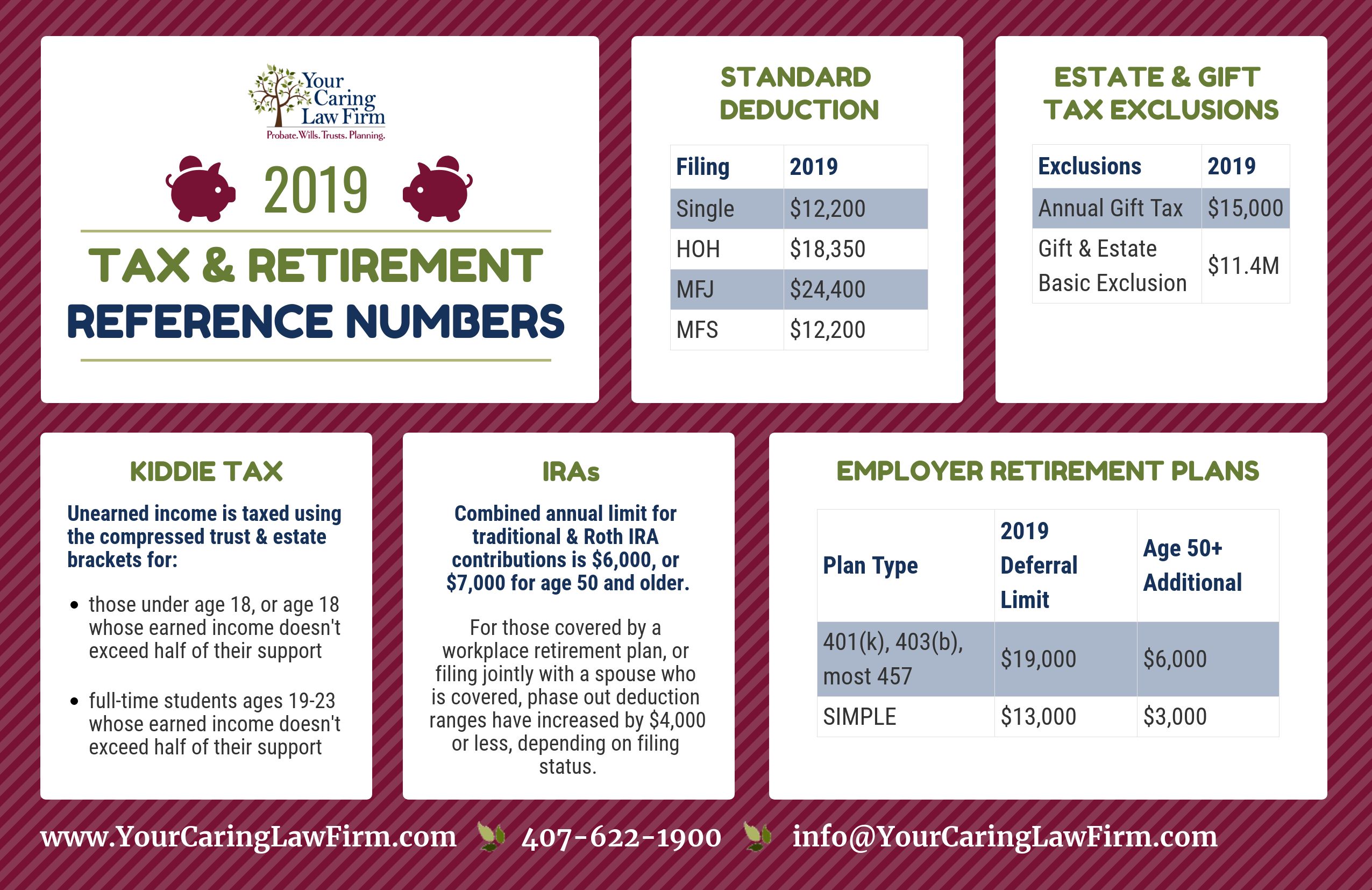

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of. Welcome to the Florida Property Tax Data Portal a service of the Florida Department of Revenues Property Tax Oversight PTO program.

Florida DOR caps assessed value of Homestead properties at 3 percent. So youd get taxed on. Under the exemption 25 percent of the just value of a first-time homestead up to 100000 will be exempt from property taxes.

2 days agoFurst subjected that portion of the property to a 10 assessment cap for those years resulting in the propertys then-primary resident Rod Rebholz being subject to a. The exemption is subtracted from the assessed value of your home. According to Florida Statute 1951556 any person or entity who owns property in excess of the 10 cap must notify the property appraiser as soon as possible if the ownership.

Depending on market factors your assessed value could increase less than 10 or could. 200065 5 FS since 2007. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

This can mean up to a 500000 decrease in the taxable value of the new home and a huge annual property tax savings. The Tax Collectors Public Service Office located at 200 NW 2nd Avenue Miami Florida 33128 is open Monday through Thursday from 830 am. No Florida estate tax is due for decedents who died on or after January 1 2005.

The new law will raise the limit on how much commercial property owners can be taxed from 1000 to 5000. There are two levels of the homestead exemption. For example if your.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. Counties in Florida collect an average of 097 of a propertys assesed fair.

Florida Homestead Exemption You can qualify for the homestead exemption on your permanent primary residence. TAMPA -- The 2022 limit for assessment value. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

The amount of the additional exemption will. For each levying authority. The maximum amount your assessment can increase from one year to the next is 10.

Central Florida Estate Planning Archives Your Caring Law Firm

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Estate Tax In The United States Wikipedia

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

What S In A Name Part 2 Tax And Other Consequences Caused By Joint Ownership Of Real Property Sgr Law

Transfer On Death Tax Implications Findlaw

The Florida Homestead Exemption Explained Kin Insurance

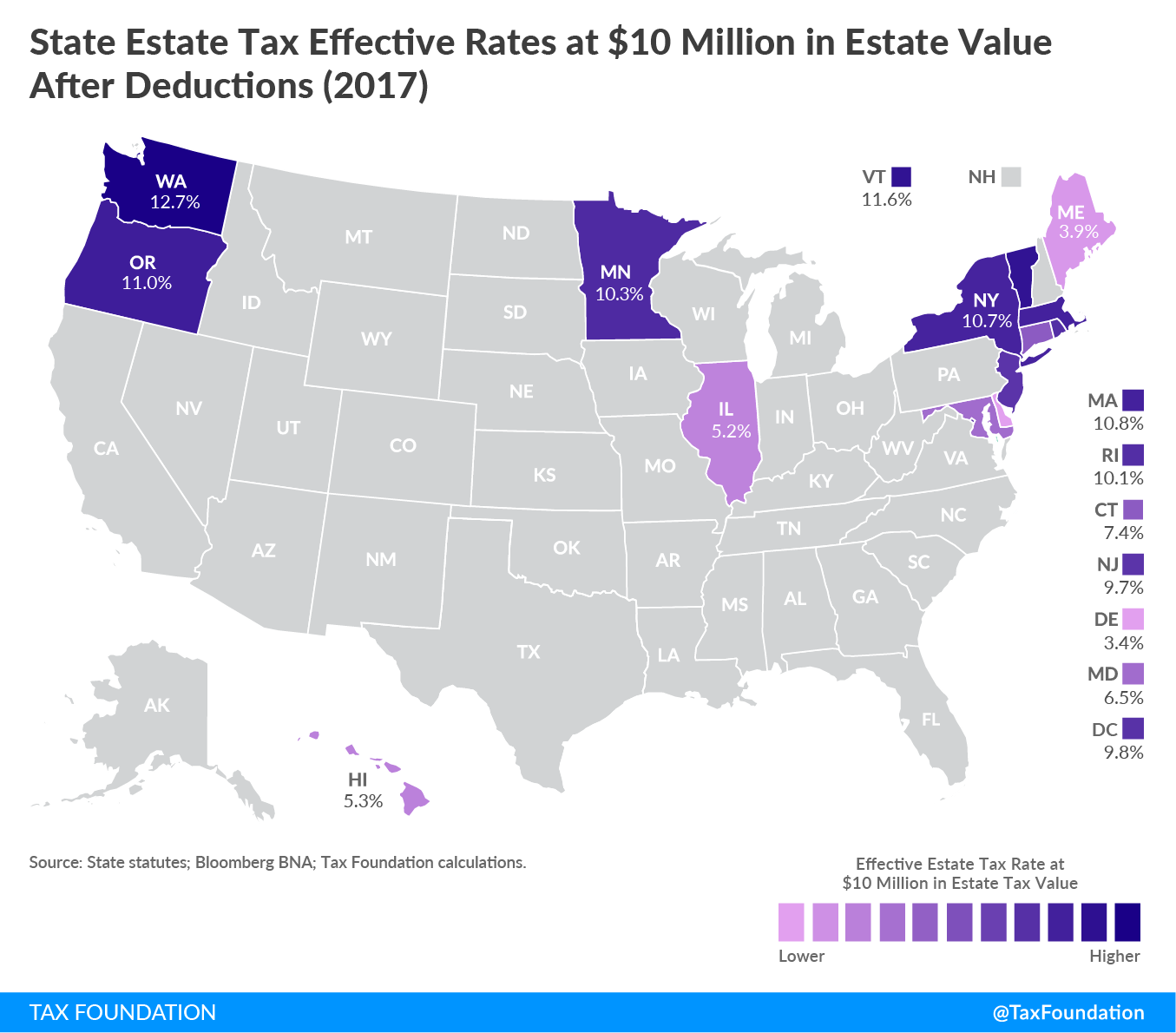

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

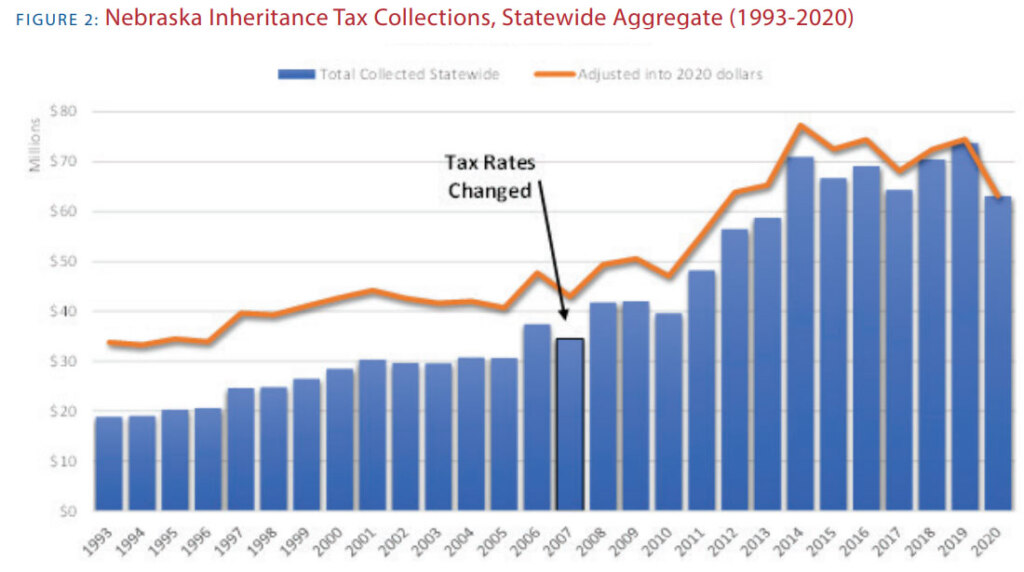

Death And Taxes Nebraska S Inheritance Tax

State Death Tax Hikes Loom Where Not To Die In 2021

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Create An Estate Plan Now To Take Advantage Of Big Tax Exemption

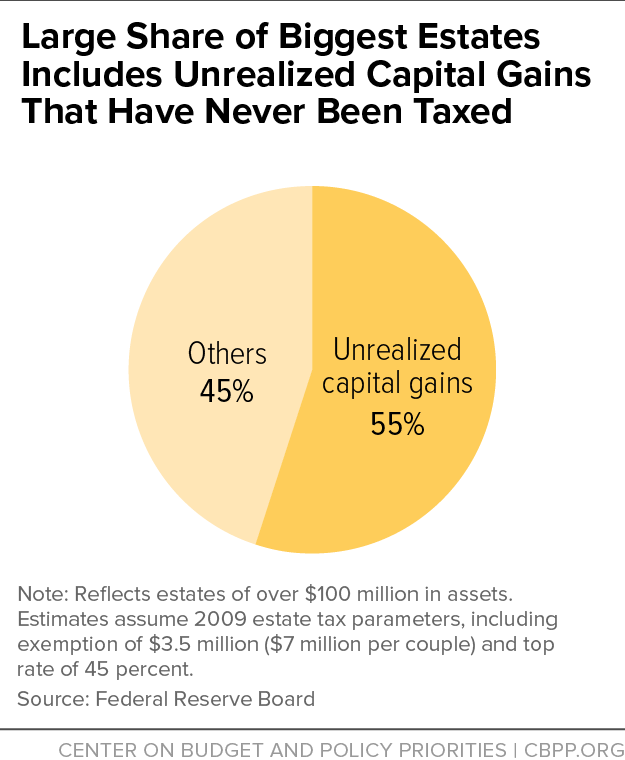

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

The Florida Homestead Exemption Explained Kin Insurance

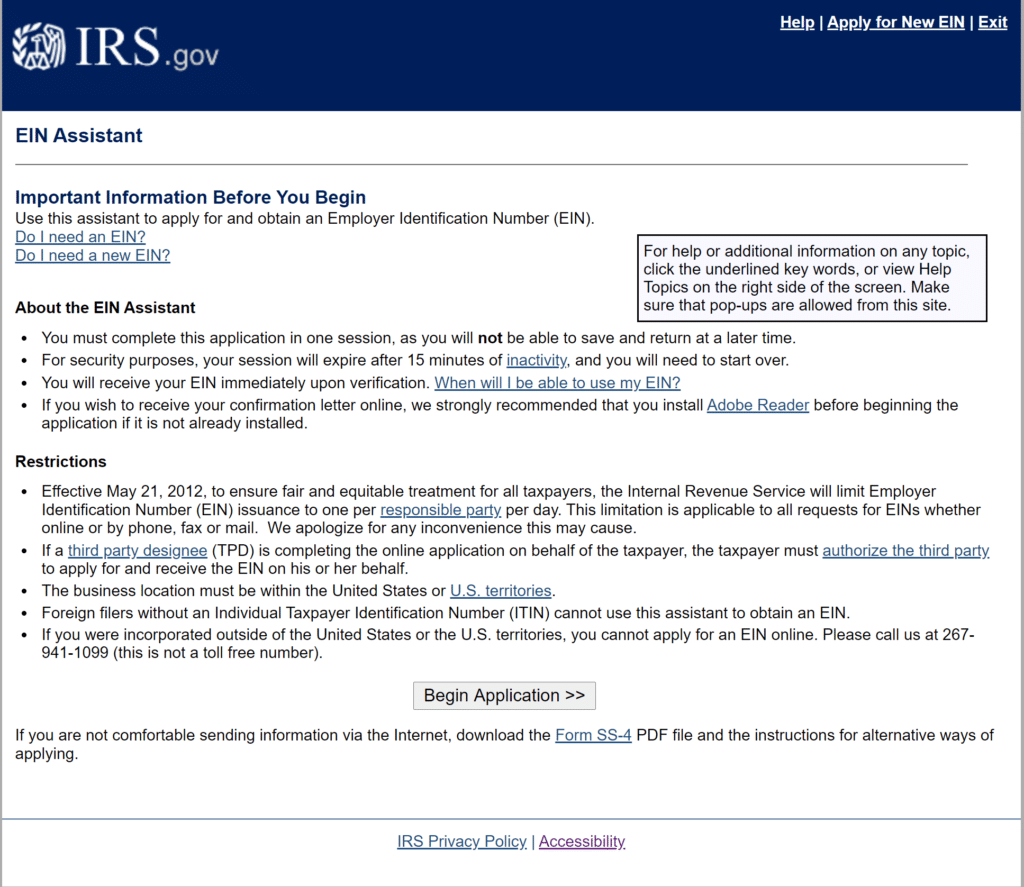

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Considering A Move To Florida What You Need To Know About Changing Domicile Pnc Insights